Farmers prosper in pandemic as Americans shop local

By Nellie Peyton

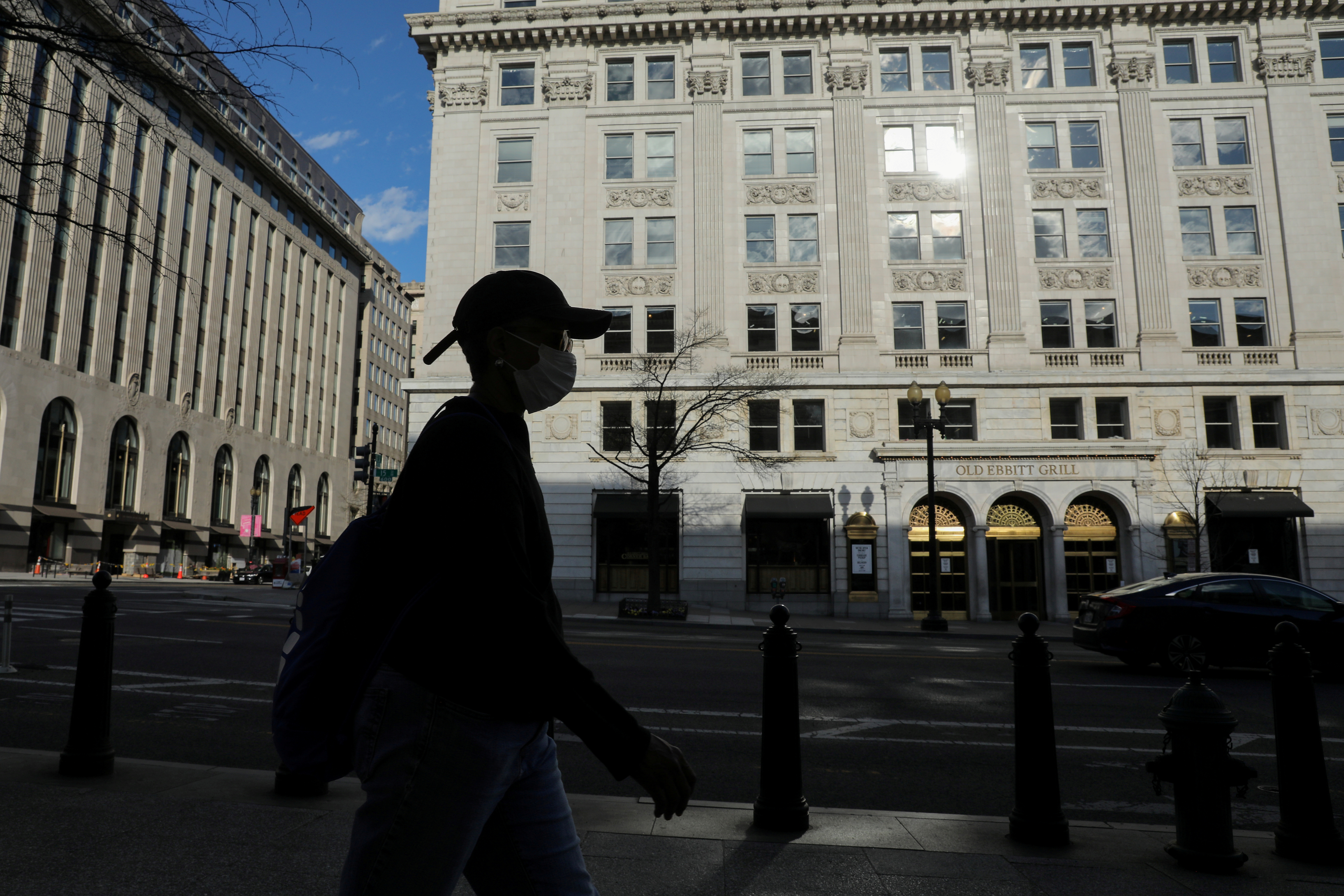

WASHINGTON (Thomson Reuters Foundation) – With restaurants shut and grocery stores posing a coronavirus risk, some Americans are ordering food directly from the farm – a trend small-scale producers hope will outlast the pandemic.

It could be one of the few economic upsides to a crisis that has emptied high streets and felled business as Americans lock down against the fast-spreading novel coronavirus.

In northern Wisconsin, a farmers’ collective said they are making thousands of dollars a week in a season when sales are normally zero.

By selling to people instead of restaurants, Illinois farmers said revenues are close to an all-time high.

Many farmers are adopting online ordering and home delivery, transforming old-fashioned farms into consumer-friendly outlets.

“In two or three weeks we accelerated like five to ten years of growth and change in the industry,” said Simon Huntley, founder of Harvie, a company based in Pittsburgh that helps farmers market and sell their products online.

“I think we are getting a lot of new people into local food that have never tried buying from their local farmer before.”

Eating local is lauded as a way to reduce the greenhouse gas emissions of transporting food long distances, although some studies have shown it is not always more climate-friendly.

Shorter supply chains boost resilience in a crisis and help small-scale sustainable farms, said Jayce Hafner, co-founder of FarmRaise, which helps farmers get grants and loans.

Growers across the country are vulnerable to economic shocks right now because of labour shortages, supply chain disruptions and fluctuating prices linked to the pandemic, she said.

“The beauty of the direct-to-consumer app is it allows a farmer to capture the value of their product at a near-to-retail price, and so it’s a really attractive option economically for a farmer,” Hafner said.

NEW EXPECTATIONS

Chris Duke, who owns a farm in Wisconsin, has managed a community-supported agriculture (CSA) program for years.

The CSA model gained popularity in the United States more than a decade ago. Typically customers pay a subscription fee to a farm then receive regular boxes of whatever is grown.

But with the spread of online shopping, shoppers are now used to getting what they want, when they want it, said Duke.

Using Harvie’s platform, his farm and 17 others in the area can offer customers 95 products, from vegetables to honey to meat, and their clients choose just what they want each week.

They had been thinking of doing this for a while, he said, but were only spurred to make the change when coronavirus hit.

“I love the CSA model, but the CSA model by itself is 30 years old, and a lot has changed in the food marketplace, in technology, in customer expectations,” Duke said. “It’s a totally different world now.”

Last week the farms made about $7,000 between them, which is huge for a season when not much is growing, he said.

He plans to keep the new model after the pandemic wanes.

CHALLENGES

Not all of the direct-to-consumer businesses are digital.

Marty Travis, a farmer in central Illinois, has been the middleman connecting local farms to restaurants for 16 years. He markets the products to chefs in the Chicago area, collects orders and distributes fresh produce each week.

When the novel coronavirus hit, he shifted gear and started selling to individuals – and was overwhelmed by demand.

“We could have 1,000 people tomorrow,” he said, but can only cater to 200 customers so had to cap orders accordingly.

He delivers to three dropoff spots in Chicago where people line up to collect – it is not home delivery but challenging nonetheless as farmers are used to bulk orders and packaging.

Proceeds are huge.

“We have to find these opportunities to celebrate some positive stuff,” said Travis, who is writing a book about how farmers can band together to feed communities.

Lisa Duff, the owner of a small family farm in Maryland, started offering customized, at-home deliveries last year and said it saved her when the restaurants and farmers’ markets she served closed in March.

Without a delivery person, she does most of the driving herself – which has been tough.

But she has also seen her customers nearly double.

“I’m hopeful that this will really truly help us find that local food is here to stay.”

(Reporting by Nellie Peyton, editing by Lyndsay Griffiths; Please credit the Thomson Reuters Foundation, the charitable arm of Thomson Reuters, that covers the lives of people around the world who struggle to live freely or fairly. Visit http://news.trust.org)